10 Baggers 2018

What is a Ten Bagger?

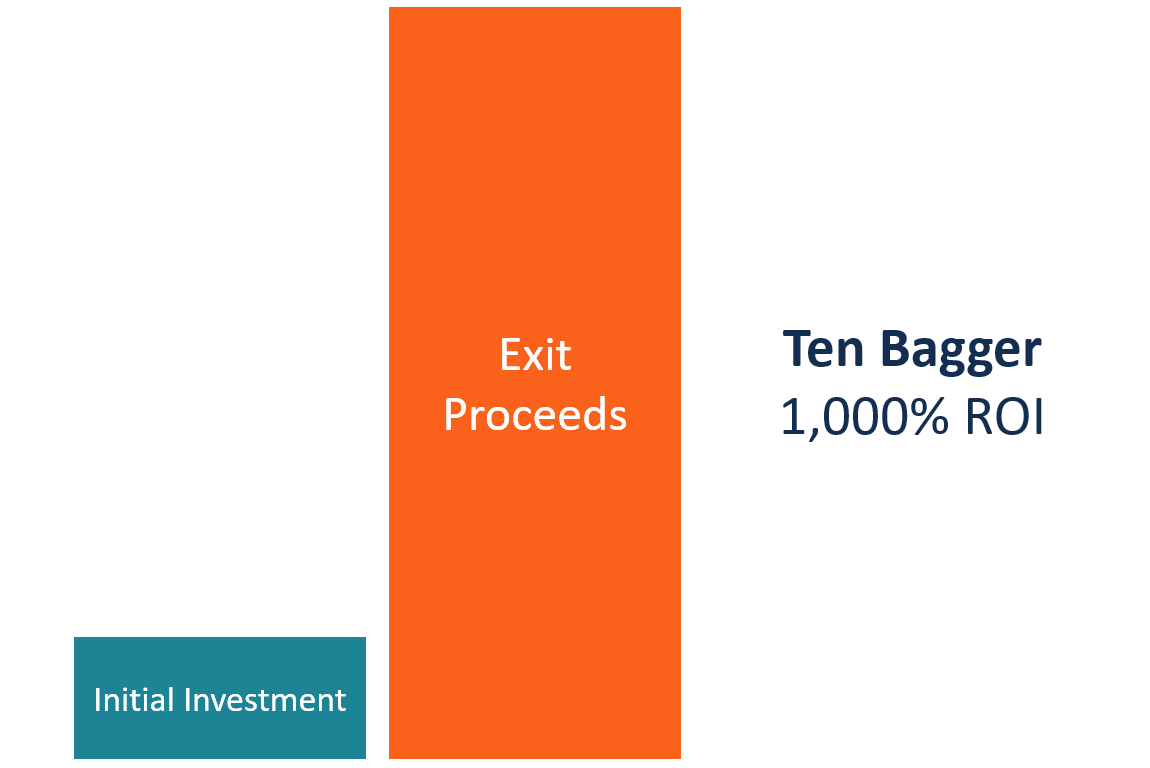

Ten bagger refers to an investment that generates a return of ten times the amount of the initial investment, i.e., a 1,000% return on investment (ROI) ROI Formula (Return on Investment) Return on investment (ROI) is a financial ratio used to calculate the benefit an investor will receive in relation to their investment cost. It is most commonly measured as net income divided by the original capital cost of the investment. The higher the ratio, the greater the benefit earned. . The term 10 bagger was popularized by famous Wall Street investor Peter Lynch, which he borrowed from baseball where additional base hits are also referred to as "baggers".

Ten baggers are mostly used to describe stocks Stock What is a stock? An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved). The terms "stock", "shares", and "equity" are used interchangeably. that grow tenfold within a given time frame. For an investor to benefit from a 10 bagger, they usually must stick with the investment for a long time.

Peter Lynch's Ten Bagger Investments

Lynch's book, first published in 1989, documented his journey as the manager of the Fidelity Magellan Fund. Lynch grew the fund's investments from $18 million to over to $19 billion during his tenure. The growth translated into an annual rate of return of 29.9%.

When choosing stocks to invest in, Lynch relied on two main criteria. First, he invested in stocks with a price-earnings ratio below the industry mean. He also considered stocks with high earnings per share Earnings Per Share (EPS) Earnings per share (EPS) is a key metric used to determine the common shareholder's portion of the company's profit. EPS measures each common share's profit that fell below the mean. He gave Wal-Mart as an example of a ten bagger investment. Lynch noted that investors who bought Wal-Mart's stock when the company went public would've earned 30 times their initial investment.

Key Attributes of a 10

When seeking a potential ten bagger investment, there are several attributes that an investor should look for:

The base effect

In a closed economy, a large company tends to grow at a slower rate than a small company operating in the same economy. Usually, a large company cannot grow beyond the economy as a whole. As it becomes bigger, the growth rate grows slowly up to a certain point, after which it becomes stagnant. When investors put their money into an already large company, there are slimmer chances of the investment growing tenfold.

Investing in small-cap stocks Small Cap Stock A small cap stock is a stock of a publicly traded company whose market capitalization ranges from $300 million to approximately $2 billion. or early-stage companies offers a higher probability of acquiring a 10 bagger.

Company valuation

An investor must consider how much the stocks of a company are worth and their chances of growth in the future. Ideal stocks for investment are those that are low-priced or little known, but with high potential to increase in value. If an investor purchases shares at a high cost, they are unlikely to get a high return because the stocks were already expensive when purchased.

For example, consider an investor who buys the $10 stock of a new technology company that is projected to grow 30% annually for the next five years. This means that the company's stock is likely to eventually pass the $100 mark, becoming a ten bagger.

Fair operating environment

The backbone of a multi-bagger is a good business operating environment. The business needs to operate in a good economic environment in order to grow rapidly. The ideal environment includes things such as fair tax laws, technology solutions, and fair competition.

Internally, the business must possess strong underlying fundamentals that act as catalysts for tenfold growth. The fundamentals comprise high profitability, optimal debt levels, high growth potential, and unique product offerings. All these characteristics can help propel a company into a ten bagger within a given time frame.

Three Principles in Finding 10 Bagger Stocks

Here are three principles investors can apply to help generate massive returns on investment.

Start small

It pays to start small. Small cap stocks see more opportunities for growth, as compared to large-cap stocks. For example, Apple Inc. is now one of the largest companies that dominate the stock market. Its market cap is almost $1 trillion (as of 2018). For the company to be a ten bagger, its market cap would need to hit $10 trillion.

Examples of large companies that started as small ones and later became ten baggers include Apple, Netflix, Google, and Tesla.

Diversify your investments

Stocks that deliver ten bagger results are difficult to find, and they take a lot of effort and betting on chances. Owning multiple stocks of high growth companies helps reduce the risks and increase the chances of some of the investments growing into multi-baggers. For example, if an investor conducts thorough market research and chooses 20 small, high potential stocks to invest in, there is a likelihood that one or more of the stocks will deliver tenbagger returns in the future.

Venture capitalists use the technique above when investing in startup companies. They invest in multiple high potential companies that offer chances of bringing massive returns to offset other investments that don't pay off.

Longer holding periods provide greater gains

While it is possible for an investment to grow tenfold within a year or two, most stocks only experience such returns within an average period of ten years. For small companies that are starting out, the initial years are crucial to propel the companies into the league of large companies within a decade.

Therefore, for investors to benefit from massive returns, they must be willing to hold on to the stocks for a long time. An investor is unlikely to get a 10 bagger if they sell the investment just a few months after buying it.

Additional resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional resources below will be useful:

- Expected Return Expected Return The expected return on an investment is the expected value of the probability distribution of possible returns it can provide to investors. The return on the investment is an unknown variable that has different values associated with different probabilities.

- Internal Rate of Return Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.

- Investing: A Beginner's Guide Investing: A Beginner's Guide CFI's Investing for Beginners guide will teach you the basics of investing and how to get started. Learn about different strategies and techniques for trading

- Return on Equity Return on Equity (ROE) Return on Equity (ROE) is a measure of a company's profitability that takes a company's annual return (net income) divided by the value of its total shareholders' equity (i.e. 12%). ROE combines the income statement and the balance sheet as the net income or profit is compared to the shareholders' equity.

Source: https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/10-ten-bagger/

Tidak ada komentar:

Posting Komentar